Black Variance Surface in PyQL

— QuantLib — 1 min read

Summary: Building Black Variance Surfaces in PyQL

In my previous post on Variance

Swaps, I neglected to mention an important implementation detail. If you look

the Variance Swap unittest or example script you'll see that replicating pricer

requires a BlackVarianceSurface object. I had to build bindings for these

in PyQL so I thought I'd mention how they work.

BlackVarianceSurface is a volatility termstructure that implements different

types of 2-d interpolation routines between implied volatility quotes. I included

two types of interpolations from the Quantlib source code:

- Bilinear

- Bicubic

To over simplify, Bilinear linearly interpolates between neighboring quotes. Bicubic uses a cubic spline routine (third order polynomial) to smoothly interpolate between points.

See for wikipedia for a nice summary of the differences between bicubic vs. bilinear interpolation.

The python interface is given in the example below

1...2dc = Actual365Fixed()3calendar = UnitedStates()4

5calculation_date = Date(6, 11, 2015)6

7spot = 659.378Settings.instance().evaluation_date = calculation_date9

10dividend_yield = SimpleQuote(0.0)11risk_free_rate = 0.0112dividend_rate = 0.013# bootstrap the yield/dividend/vol curves14flat_term_structure = FlatForward(15 reference_date=calculation_date,16 forward=risk_free_rate,17 daycounter=dc18)19

20flat_dividend_ts = FlatForward(21 reference_date=calculation_date,22 forward=dividend_yield,23 daycounter=dc24)25

26dates = [27 Date(6,12,2015),28 Date(6,1,2016),29 Date(6,2,2016),30 Date(6,3,2016),31]32

33strikes = [527.50, 560.46, 593.43, 626.40]34

35data = np.array(36 [37 [0.37819, 0.34177, 0.30394, 0.27832],38 [0.3445, 0.31769, 0.2933, 0.27614],39 [0.37419, 0.35372, 0.33729, 0.32492],40 [0.34912, 0.34167, 0.3355, 0.32967],41 [0.34891, 0.34154, 0.33539, 0.3297]42 ]43)44

45vols = Matrix.from_ndarray(data)46

47# Build the Black Variance Surface48black_var_surf = BlackVarianceSurface(49 calculation_date, NullCalendar(), dates, strikes, vols, dc50)51

52strike = 600.053expiry = 0.2 # years54

55# The Surface interpolation routine can be set below (Bilinear is default)56black_var_surf.set_interpolation(Bilinear)57print("black vol bilinear: ", black_var_surf.blackVol(expiry, strike))58black_var_surf.set_interpolation(Bicubic)59print("black vol bicubic: ", black_var_surf.blackVol(expiry, strike))As a sanity checked, I re-implemented results from an excellent blog post by Gouthaman Balaraman. In that post, the author builds a BlackVarianceSurface object using Quantlib's swig bindings.

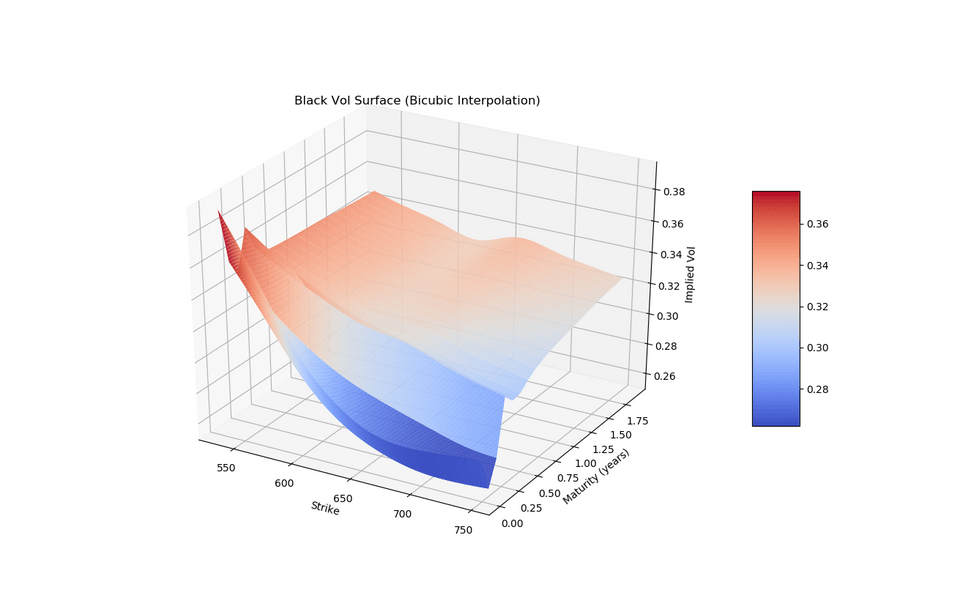

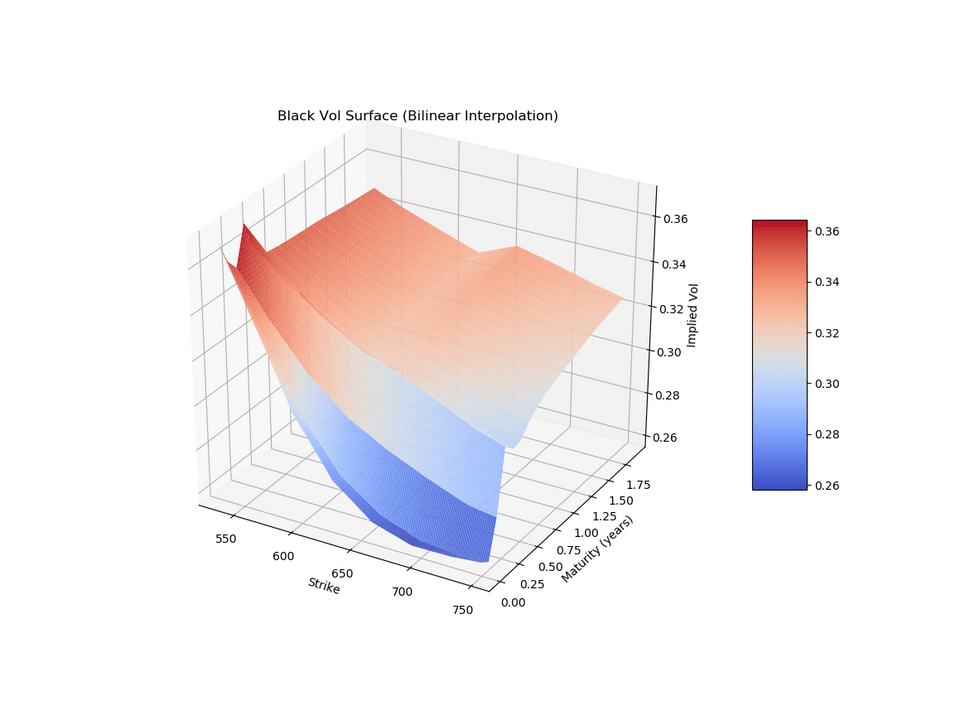

The plots for the same market data are given below:

For Bilinear interpolation, the surface looks like

For Bicubic interpolation, the surface looks like

As you can see from the plots, the bicubic is slightly smoother than bilinear.

Take a look at the PyQL bindings on my github page to see how the

BlackVarianceSurface is implemented. The script to generate the plots is here

One thing that I clearly need to improve is the flexibility on the volatility data

structure input to the BlackVarianceSurface constructor. It would be better to

allow the vols data structure to be either a list of lists, a numpy array,

or a QL Matrix object. I'll try to fix that at some point.

See you next time.