Simulating the Heston Process

— Numerical Methods, QuantLib — 3 min read

Summary: We investigate different discretization schemes for the Heston Process, looking at issues of numerical bias and ease of implementation

In today's post, I will examine a few issues related to numerical simulation of the Heston model. As a quick reminder, the Heston process is a stochastic volatility model defined by the following sde:

for asset price St. dWts and dWtν are Wiener processes with correlation ρ. As usual, r and d are the risk free and dividend rates respectively.

The Heston model is an excellent benchmarking model due to the surprising fact that it's probability distribution function (pdf) has a closed formed expression. It's a one of five such processes in 1 or 2 dimensions PHL. With the closed form pdf, we can easily compare the performance of the Heston model's numerical simulation by comparing PV's of a Monte Carlo pricer with an analytic pricer.

To carry out a numerical simulation we first need to choose a discretization scheme. That is, we need to approximate the infinitesimal diffusion process with a finite scheme to be used in the simulation code. Any such scheme may potentially introduce bias into the simulation that could alter the realized moments of the pdf.

The simplest possible scheme is a first order expansion, i.e. an Euler Mayorana (or just ''Euler'') scheme. Transforming to lnS and discretizing t to step size Δ gives

However, it turns out that this scheme does introduce bias. Furthermore, in this scheme it's possible to drive the variance process to negative values, which is outside the range of the pdf and causes the simulation to stop as V becomes imaginary.

One immediate fix to this problem is the floor V at 0, giving the so called "Truncated" scheme. Other schemes are based on higher order expansions of the sde or utilizing the closed form expression for the pdf. These are documented extensively in the literature Anderson. We list some of the schemes below

- Euler Mayorana

- Truncated

- Quadratic Exponential

- Broadie Kaya (Exact Simulation)

Broadie Kaya is based off direct sampling from the pdf but is rather difficult to implement numerically. The Quadratic Exponential (developed in Anderson) approximates the pdf using simplified functions and moment matching. The pdf for high and low values of the variance are matched against two different functions and threshold is implemented to switch between the two functions during a diffusion. This technique allows one to minimize variance while also easing the numerical implementation. As such, this scheme it is often the preferred scheme for Heston simulations.

QuantLib Implementation

QuantLib includes several of these discretization schemes in their Heston Process class. Let's see what a simulation looks like.

Quick note: Although the HestonProcess class is available through the SWIG bindings, it does not expose the discretizations argument. Instead, we use PyQL, which has all the discretizations available.

1from quantlib.processes.heston_process import *2from quantlib.quotes import SimpleQuote3from quantlib.settings import Settings4from quantlib.termstructures.yields.flat_forward import FlatForward5from quantlib.time.api import today, TARGET, ActualActual, Date, Period, Years6from quantlib.models.equity.heston_model import (HestonModel,7 HestonModelHelper)8from quantlib.pricingengines.api import (AnalyticHestonEngine)9from quantlib.pricingengines.vanilla.mceuropeanhestonengine import MCEuropeanHestonEngine10from quantlib.instruments.api import (PlainVanillaPayoff,11 EuropeanExercise,12 VanillaOption,13 EuropeanOption)Defining the Heston Process

1def flat_rate(forward, daycounter):2 return FlatForward(3 forward = forward,4 settlement_days = 0,5 calendar = TARGET(),6 daycounter = daycounter7 )8

9settings = Settings.instance()10settlement_date = today()11settings.evaluation_date = settlement_date12

13day_counter = ActualActual()14interest_rate = 0.715dividend_yield = 0.416

17risk_free_ts = flat_rate(interest_rate, day_counter)18dividend_ts = flat_rate(dividend_yield, day_counter)19

20maturity = Period(10, Years)21exercise_date = settlement_date + maturity22

23# spot24s0 = SimpleQuote(100.0)25

26# Available descritizations27#PARTIALTRUNCATION28#FULLTRUNCATION29#REFLECTION30#NONCENTRALCHISQUAREVARIANCE31#QUADRATICEXPONENTIAL32#QUADRATICEXPONENTIALMARTINGALE33#BROADIEKAYAEXACTSCHEMELOBATTO34#BROADIEKAYAEXACTSCHEMELAGUERRE35#BROADIEKAYAEXACTSCHEMETRAPEZOIDAL36

37# Heston Model params38v0 = 0.0539kappa = 5.040theta = 0.0541sigma = 1.0e-442rho = -0.543

44def gen_process(desc):45 process = HestonProcess(risk_free_ts,46 dividend_ts,47 s0,48 v0,49 kappa,50 theta,51 sigma,52 rho,53 desc)54 return process55

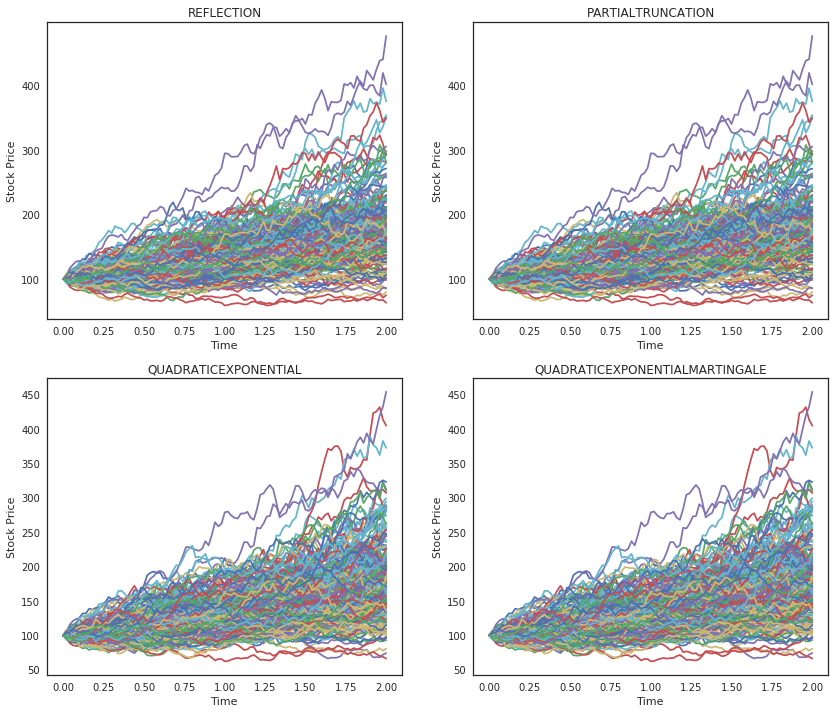

56processes = {57 "REFLECTION" : gen_process(REFLECTION),58 "PARTIALTRUNCATION" : gen_process(PARTIALTRUNCATION),59 "QUADRATICEXPONENTIAL" : gen_process(QUADRATICEXPONENTIAL),60 "QUADRATICEXPONENTIALMARTINGALE" : gen_process(QUADRATICEXPONENTIALMARTINGALE),61}Visualizing the Simulation

Note: The simulate function is not part of Quantlib. It has been added to the PyQL interface (see folder quantlib/sim).

1from quantlib.sim.simulate import simulate_process2from quantlib.time_grid import TimeGrid1import pandas as pd2import numpy as np3import matplotlib.pyplot as plt4%matplotlib inline5import seaborn as sns6sns.set(style="white", rc={"axes.facecolor": (0, 0, 0, 0)})1# simulate and plot Heston paths2paths = 2003steps = 1004horizon = 25seed = 1546

7grid = TimeGrid(horizon, steps)8

9fig, axs = plt.subplots(figsize=(14, 12), nrows=2, ncols=2)10flat_axs = axs.reshape(-1)11

12for i, key in enumerate(processes.keys()):13 flat_axs[i].plot(list(grid), simulate_process(processes[key], paths, grid, seed))14 flat_axs[i].set_xlabel('Time')15 flat_axs[i].set_ylabel('Stock Price')16 flat_axs[i].set_title('%s' % key)

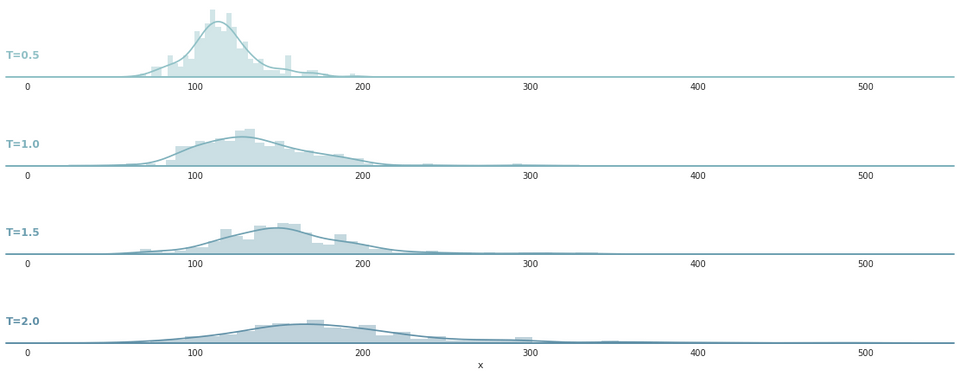

Let's look at of the diffusions in detail, for example the evolution of the Heston process using Partial Truncation looks like this

1res = simulate_process(processes["PARTIALTRUNCATION"], paths, grid, seed)2x = res[[25,50,75,100],:].reshape(4*paths)3

4g = np.repeat(["T=0.5","T=1.0","T=1.5","T=2.0"], paths)5df = pd.DataFrame(dict(x=x, g=g))6

7# Initialize the FacetGrid object8pal = sns.cubehelix_palette(10, rot=-.25, light=.7)9g = sns.FacetGrid(df, row="g", hue="g", aspect=10, size=1.6, palette=pal)10

11g.map(sns.distplot, "x", bins=40, kde=True, rug=False)12g.map(plt.axhline, y=0, lw=2, clip_on=False)13

14

15def label(x, color, label):16 ax = plt.gca()17 ax.text(0, .3, label, fontweight="bold", color=color,18 ha="left", va="center", transform=ax.transAxes)19

20g.map(label, "x")21g.fig.subplots_adjust(hspace=.25)22g.set_titles("")23g.set(yticks=[])24g.despine(bottom=True, left=True)

Comparing the PV's of different engines

To examine the performance of the numerical schemes, we simply compare the PV's the same Call Option priced with an analytic and Monte Carlo engine. The results for different time steps and schemes are given in the table below

1# Build a Call Option2payoff = PlainVanillaPayoff('Call', 105)3exercise = EuropeanExercise(exercise_date)4option = EuropeanOption(payoff, exercise)5

6results = {"REFLECTION" : [],7 "PARTIALTRUNCATION" : [],8 "QUADRATICEXPONENTIAL" : [],9 "QUADRATICEXPONENTIALMARTINGALE" : [],10}11

12# steps per year13steps = [1, 4, 8, 16]14

15for k, v in processes.items():16 for step in steps:17 mc_engine = MCEuropeanHestonEngine(v,18 steps_per_year=step,19 required_samples=500,20 seed=1234,21 )22 option.set_pricing_engine(mc_engine)23 results[k].append((np.around(option.npv, 5), np.around(option.error_estimate, 5)))24

25

26results["time steps per year"] = steps27results_df = pd.DataFrame(data = results)28cols = results_df.columns.tolist()29cols = cols[-1:] + cols[-2:-1] + cols[:-2]30results_df = results_df[cols]1results_df| time steps per year | REFLECTION | PARTIAL TRUNCATION | QUADRATIC EXPONENTIAL | QUADRATIC EXPONENTIAL MARTINGALE |

|---|---|---|---|---|

| 1 | (1.64404, 0.05392) | (1.74109, 0.03607) | (1.71144, 0.02744) | (1.71527, 0.02811) |

| 4 | (1.64447, 0.06608) | (1.74109, 0.03607) | (1.71144, 0.02744) | (1.71527, 0.02811) |

| 8 | (1.98966, 0.04768) | (1.77399, 0.03692) | (1.70905, 0.02727) | (1.73049, 0.02829) |

| 16 | (1.80227, 0.03563) | (1.75864, 0.0351) | (1.70581, 0.02687) | (1.72956, 0.02818) |

Conclusion

As we saw, there are many ways to simulate the Heston model, each with strengths and weaknesses with regards to bias/accuracy and runtime performance. In general, the Quadratic Exponential scheme performed better than Euler-type schemes, especially for simulations with fewer time steps per year.

In a future post, I will visit the local stochastic volatility version of the Heston model to see how it's simulation works.

Is there a better way?

If you take a look at the HestonProcess class file in QuantLib you will see that it, for each discretization, there is a different diffusion implementation. The user chooses the discretization from an enumerated list. The downside to this approach is that , in addition to creating bloated code, the list is always finite. What happens when someone wants to create a new discretization scheme that's not on the list? She has to add the diffusion implementation directly into the HestonProcess class.

A better approach might be to allow the user to build her own discretization in Python and then "compile-down" to C++ in the similar way to how the finite difference stencils are created in Devito [see my earlier post] This may just be hopeful speculation on my part :). Until next time.